Volatility is nothing new for insurance company investment managers but the causes and consequences of the current market challenges are different. This was one of the key themes of the latest Insurance Investment Exchange virtual seminar.

Entitled Quo Vadis: Inflation, Out of Cash and Becoming Climate Aware, the first of two morning sessions stepped back to look at the big picture with macro-economic trends, inflation, the role of central banks, ESG and climate change all highlighted as key influences on insurer investment strategies and portfolios, writes Contributing Editor David Worsfold.

Frank Eich, former senior adviser in the International Directorate at the Bank of England, set the scene by looking at the possible routes to recovery. He warned that the recovery was shrouded in uncertainty, driven by four key factors:

- The success of vaccines in combatting the virus

- The potential boost to private consumption as savings are released

- Business investment and the response of financial markets

- The performance of global supply chains, especially when faced with bottlenecks

Overall, he warned that “the recovery of the global economy is really quite fragile” and that inflation should not be written off as a risk, especially as interest rate rises could kill the recovery.

He also challenged the belief that central banks were now policymakers, especially when it comes to responding to climate change: “Central banks shouldn’t be centre stage when it comes to policy making … people need to understand that governments set policy and that central banks only have operational independence”, although they have “the tools to step in if we have to”.

Eich was joined on a lively panel session by David Page, Head of Macro Research at Axa Investment Managers, and Erik Vynckier, Chair, Research and Thought Leadership at the Institute and Faculty of Actuaries.

The impact of climate change and the growing focus on ESG policies proved controversial with Vynckier dismissive of the current approach of governments and regulators, which he said had “socialised” the corporate debt market.

“We seem to be the tool for the implementation of government policy. The government wants to regulate Unilever not by talking to Unilever but by forcing 60,000 financial institutions worldwide who do business with Unilever to report on what Unilever is doing. I find that very awkward and very inefficient but that is what ESG is all about. I don’t think we have the skills and expertise for it.”

When it comes to climate change, Eich said governments must take the lead as markets have not delivered. Chasing consumption growth without new constraints is not an option: “If we continue to consume in the future as we have done in the past we will have a serious problem”, he said.

One of Eich’s key worries was whether policymakers have the “staying power” to see through serious responses to climate change. Page said he believed that the Biden presidency and the new commitment of China to positive action to reduce CO2 emissions presented an opportunity.

“We are in a sweet spot at the moment in that all major governments are aligned as they want to take action to mitigate the damage we have done to the planet … that is quite exceptional.” If this changes and governments diverge in the future it “could cause significant tensions in the global economy", he warned.

If this changes and governments diverge in the future it “could cause significant tensions in the global economy", he warned.

Turning the heightened awareness and regulatory focus on climate-related risks into deliverable investment strategies was the theme of the final session of the morning, presented by Bruno Bamberger, Fixed Income Solutions Strategist, and Rob Price, Portfolio Manager – Buy and Maintain Credit, from Axa Investment Managers.

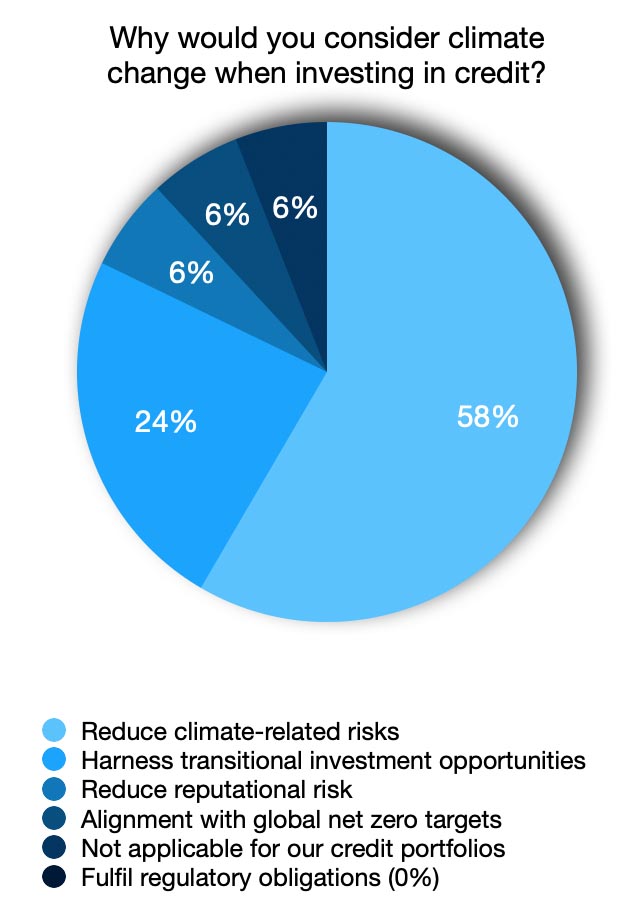

They opened by asking the virtual audience what their motivation was for taking climate change into account. Overwhelmingly, the response was to reduce climate-related risks with regulatory pressures not even registering, suggesting CIOs are owning the challenge rather than being pushed into acting (see chart).

The Axa team took people through a case study showing how a portfolio could be assessed for the Climate Value at Risk for different global temperature rise scenarios – 1.5°C, 2°C and 3°C. They explored how the responses to the risks identified should be varied with some investments changed altogether but others managed through engagement with the firms.

• Look out next week for a report on day two of the seminar when the focus switched to the long-standing challenges of operating in a low yield environment.