The UK life insurance sector’s solvency ratios are currently at a record high, according to Fitch Ratings.

This should reassure people that the UK government’s proposed relaxation of the rules inherited from the European Union’s Solvency II regime will pose little threat to the security of UK life insurers, says the ratings agency. Consequently, it expects very few changes to ratings, writes Contributing Editor David Worsfold.

“While we expect insurers to deploy some of the capital freed up by the S2 reforms into long-term investments, attracted by the prospect of higher returns, we believe they would stay within their existing risk appetites and avoid depleting their capital enough to jeopardise ratings”, says Fitch.

Commenting on the views Andrew Bailey, Governor of the Bank of England, recently offered to Parliamentary committee that, for a firm just meeting the minimum S2 requirements, this could equate to an increase in the probability of failure over a one-year period from 0.5% to 0.6%, Fitch says this is a pessimistic analysis.

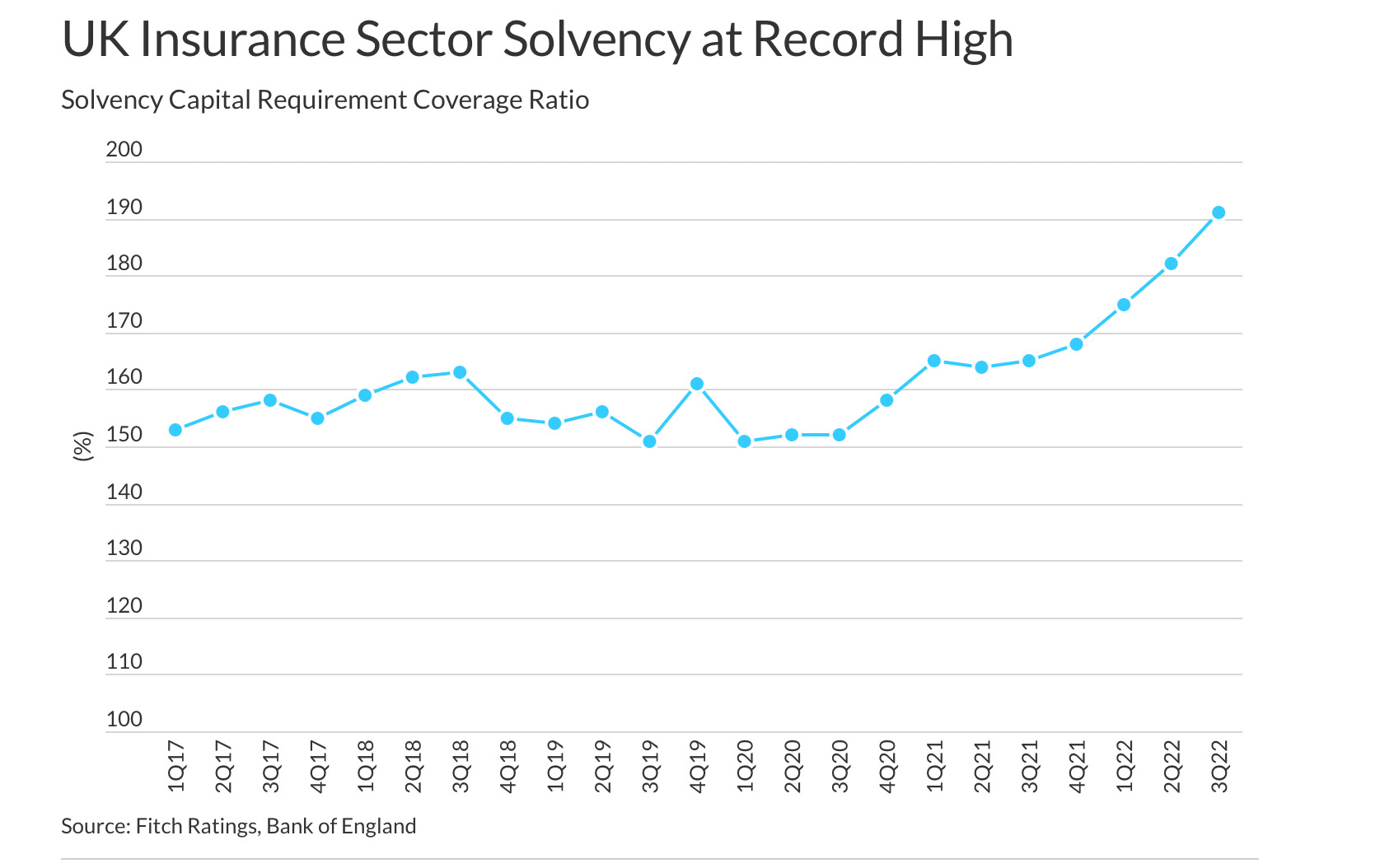

Its own analysis shows that most life insurers maintain Solvency II ratios well above the minimum requirements, “which implies a much lower probability of failure than 0.5%”. This sense of security has been enhanced by the steady rise in solvency rations since the end of 2020 (see chart).

Its own analysis shows that most life insurers maintain Solvency II ratios well above the minimum requirements, “which implies a much lower probability of failure than 0.5%”. This sense of security has been enhanced by the steady rise in solvency rations since the end of 2020 (see chart).

Fitch says it has doubts about the impact of some of the proposed changes to the matching adjustment requirements in the UK’s new solvency regime, which is projected, at least by the government and industry trade bodies, to release between £12bn and £14bn a year over the next ten years for investment in infrastructure and other long term assets.

Under the proposals, assets with prepayment risk or construction phases would be eligible as matching adjustment assets, potentially increasing the supply of long-term assets, particularly in infrastructure.

One of the main challenges from a policy standpoint has been that insurers’ infrastructure investments have been confined to established projects with fixed cashflows. The changes will make them more attractive that comes at a price, says the agency: “Enabling insurers to invest in early-stage projects could stimulate investment in the sector, but would add risk.”

There are also technical reasons for being cautious about expecting a sudden flow of billions of fresh investment into infrastructure projects:“The eligibility criteria for matching adjustment assets would also be widened to include assets with ‘highly predictable’ cash flows rather than just those with fixed cash flows. This could further increase the supply of potentially attractive assets. However, insurers often worked around the existing requirement by restructuring assets to create fixed cash flows. In such cases, the new criteria would simply remove the frictional cost of restructuring rather than increasing the supply of underlying assets. In addition, the government has indicated that assets without fixed cash flows may be given less matching adjustment credit in the liability discount rate, which could limit their attractiveness.”

Others have urged greater realism about expecting money freed up by the reforms to flow into infrastructure and similar assets, pointing out that without any direction from the Treasury or the Prudential Regulation Authority it is likely that some will go into boosting the traditional asset mix of insurers and some may be returned to shareholders.

- Our next roundtable for insurance company CIOs and senior investment team members will ponder the opportunities thrown by the trillion Dollar wide trade finance gap that now exists globally. It will explore the key dynamics in the trade finance space and how insurers are increasingly looking to the strategy's flexibility and compelling returns to navigate today's environment of heightened geopolitical tensions, volatile bond yields and rising inflation.

Entitled ‘A Trillion-wide Finance Gap: Opportunities in volatile times for insurers’, it will be hosted by Allianz Global Investors at its Bishopsgate offices on Wednesday 19 April from 10am to 12 noon.